Personal Planning

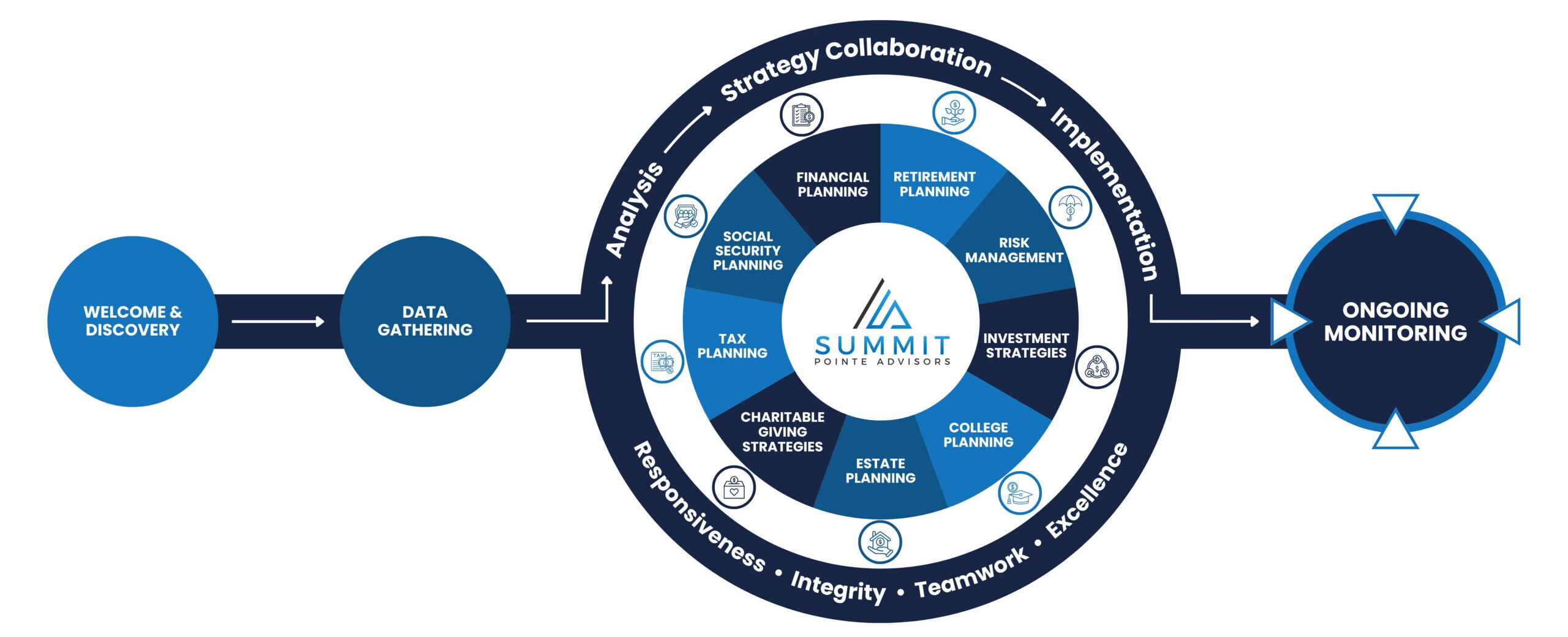

Simplifying Personal Planning

Financial planning with a financial advisor is a collaborative process to help manage your money and create a financial plan designed for securing your financial future. The advice provided by your financial advisor integrates elements from both your personal and financial circumstances to help you meet your life goals, from short-term goals to leaving a lasting legacy.

The overall goal is to help you make informed decisions so you can build wealth, minimize financial stress, and reach your personal life goals-whether that’s buying a home, sending kids to college, traveling, or retiring comfortably.

Financial planning will look a little different for everyone, but there are some common trends to planning outlined below. The chart below is more of a guideline, with each stage building off of the last.

Personal Planning

Financial planning with a financial advisor is a collaborative process to help manage your money and create a financial plan designed for securing your financial future. The advice provided by your financial advisor integrates elements from both your personal and financial circumstances to help you meet your life goals, from short-term goals to leaving a lasting legacy.

Financial plan recommendations can be implemented with the advisor of your choosing. Implementation of specific products or services may result in commissions or fees outside of the financial planning fee.

Early Career

Focus: Building A Strong Foundation

Key Services:

Budgeting & Cash Flow Management

Establishing spending plans and building habits.

Emergency Fund Planning

Setting aside 3-6 months of expenses.

Repayment Strategies

Student loans, credit cards, and starting to build credit.

Basic Investing

Starting retirement accounts (like 401(k), IRA), understanding risk tolerance.

Employer Benefits Optimization

Health insurance, retirement plans, HSA/FSA.

Short-Term Goal Planning

Saving for travel, car, or first home.

Insurance Protection Products

Health insurance, renters and auto insurance products offered by unaffiliated insurers.

Key Services:

Comprehensive Investment Strategy

Diversifying portfolio, increasing contributions.

Home Purchase & Mortgage Planning

Buying or upgrading a home.

Family & Education Planning

College savings (529 plans), child-related expenses.

Advanced Tax Planning*

Using deductions, credits, and tax-efficient investing.

Insurance Reviews

Life, disability, and possibly long-term care insurance.

Estate Planning Basics

Wills, powers of attorney, guardianship for kids.

Career Transition Planning

Starting a business, job change, or side income.

Mid-Career

Focus: Growth And Protection

*Neither MML Investors Services, LLC nor any of its subsidiaries, employees or representatives are authorized to give legal or tax advice. Consult your own personal attorney legal or tax counsel for advice on specific legal and tax matters.

Late Career

Focus: Retirement readiness and legacy planning

*Neither MML Investors Services, LLC nor any of its subsidiaries, employees or representatives are authorized to give legal or tax advice. Consult your own personal attorney legal or tax counsel for advice on specific legal and tax matters.

Key Services:

Retirement Income Planning

Estimating expenses and income sources (Social Security, pensions, and investments).

Asset Allocation Adjustments

Risk minimization strategies, strategies designed to help increase income-producing assets.

Health Care & Medicare Strategies

Evaluating options and costs.

Social Security Review

Discuss timing options and strategies

Estate Planning*

Trusts, legacy goals, charitable giving, and minimizing estate taxes.

Required Minimum Distributions (RMDs)

Planning around IRA/401(k) withdrawals.

Downsizing & Lifestyle Planning

Considerations around living arrangements and budgeting for retirement activities.

Personal Planning Services

Financial Planning

The process of setting goals for your money and creating a strategy to achieve them. It involves evaluating your current financial situation, identifying your short-term and long-term financial objectives, and developing a roadmap to reach these goals. Financial planning can encompass each of the categories below as part of a wholistic approach.

Key Aspects of Financial Planning Include:

SMART Goals

Budgeting

Saving

Investing

Why It's Important:

Financial planning is important because it helps you manage your money wisely, achieve your goals, and prepare for unexpected events. It brings clarity, control, and confidence to your financial future.

Retirement Income Planning

The process of helping ensure you have enough reliable income to cover your expenses throughout retirement. We help you figure out how to turn your savings and other assets into a steady income stream designed to last the rest of your life.

Key Elements of Retirement Income Planning Include:

Estimating Retirement Expenses

Withdrawal Strategies

Longevity & Risk Management Strategies

Identifying Income Sources

Tax Efficiency

Legacy & Estate Goals

Why It's Important:

Financial Planning can help address risks such as outliving your money, paying more in taxes than necessary, or not being able to meet your goals for retirement. A strong retirement income plan can give you clarity and confidence.

Risk Management

This is the process of identifying, evaluating, and minimizing financial risks that could derail your goals or cause major setbacks. The goal is to protect your income, assets, and help minimize the impact of unexpected events on your future plans.

Key Elements of Personal Risk Management Include:

Insurance Planning

- Life (Term, Whole, Variable, and Universal life insurance)

- Umbrella

- Excess Liability

- Property and Casualty

Maximizing selection of company benefits

Emergency Fund

Why It's Important:

Even the best financial plan can unravel if you’re not protected from life’s “what-ifs.” Risk management strategies can create safety nets to help you recover from setbacks and minimize the impact to your long-term goals.

Investment Strategies

Investment strategies are diversified methods used to allocate and manage your money in different assets – like stocks, bonds, or mutual funds – to achieve specific financial goals. They guide decisions based on factors like risk tolerance, time horizon, and market conditions.

Key Elements of Investment Strategies Include:

Diversification of Investments

UMA (Unified Managed Account) with open architecture offering:

- 5,500+ ETFs

- Strategic and tactical asset allocation - strategies

- 16,500+ mutual funds

- 500+ SMAs

- 100+ Bond portfolios

Brokerage Services

- Stocks

- Mutual funds

- ETFs

- CDs

- Bonds

- Money market

Annuities

- Fixed

- Income

- Variable

- Index-Linked

Risk Tolerance

Why It's Important:

Investment strategies such as diversification and asset allocation are designed to help reduce risk over time and ensure your investments align with your goals, risk tolerance, and timeline. They provide structure and discipline and reduce emotional decisions. While diversification and asset allocation do not guarantee a profit or protect against loss in declining markets and there is no guarantee that a diversified portfolio will outperform a non-diversified portfolio or that diversification among asset classes will reduce risk, these are well-known and used risk management strategies.

College Planning

Key Elements of College Planning Include:

529 plans, custodial accounts (UGMA/UTMA)

Financial Aid Optimization

Debt Repayment Strategies – understanding federal loan options, limits and repayment terms

Tax Strategies

Why It's Important:

Taking the time to plan for college helps minimize reliance on student loans and can include strategies to help minimize or prevent long-term debt. Your financial planner can help you with ways to find balance when saving for both retirement and college at the same time or along with other financial goals such as home ownership and emergency savings.

Estate Planning

The process of organizing how your assets will be managed, preserved, and distributed in the event of your death or incapacitation. It is designed to ensure that wishes are carried out and can help minimize legal complications, taxes, and family conflicts.

Key Elements of Estate Planning:

Legal Documents

Will, trusts, powers of attorney, healthcare proxy, living will

Beneficiary designations on accounts

Estate tax planning

Why It's Important:

By having your affairs in order, you are helping to ensure that your wishes are honored, and are designed to lessen the likelihood that probate delays or court involvement will impact your estate planning. Additionally, by planning ahead of time, you can help ensure more funds go towards your legacy by minimizing estate taxes and legal costs.

Charitable Giving Strategies

Key Elements of Charitable Giving Strategies:

Qualified Charitable Distributions

Planned Giving

(Legacy Gifts)

Charitable Trusts

- Charitable Remainder Trusts

- Charitable Lead Trusts

Why It's Important:

Charitable giving strategies provide ways to maximize your tax benefits, increase the impact of your gifts, and create a legacy. It can also be an effective tool to fulfill your RMD obligations by supporting a charity while minimizing taxes on your distributions.

Tax Planning

The process of organizing your finances in a way that is designed to minimize your tax liability – both now and in the future. It’s a key part of financial planning that helps ensure you keep more of what you earn and avoid surprises come tax time.

Any discussion of taxes is for general information purposes only, does not purport to be complete or cover every situation, and should not be construed as legal, tax or accounting advice. Clients should confer with their qualified legal, tax and accounting advisors as appropriate.

Key Elements of Tax Planning:

Income Planning

Deductions and Credits

Retirement Distribution Planning

Estate and Gift Planning

Tax-Advantaged Accounts

Capital Gains Management

Business and Self-Employment Strategies

Charitable Giving

Why It's Important:

It helps ensure you’re making the most of available deductions, credits, and tax-advantaged accounts while aligning your financial decisions with long-term goals. Effective tax planning also helps minimize or avoid surprises, penalties, and unnecessary stress during tax season.

Social Security Education

The process of strategically discussing the options of when and how to claim Social Security benefits to maximize your lifetime income. It involves analyzing factors like your age, work history, spousal benefits, and life expectancy to help you make the most informed decision.

Key Elements of Social Security Education Seeks to:

Maximize Lifetime Benefits

Reduce Tax Impact

Coordinate with Overall Retirement Plan

Why It's Important:

Being educated about and discussing the options available to you can help you make the most informed decision about your Social Security for your overall financial future.