Business Planning

Simplifying Business Planning

Financial planning with a financial advisor is a collaborative process. This is especially true for business planning, where planning can be more complex. We make the most of your planning by working in conjunction with attorneys and accountants to help ensure proper alignment of your business goals in a seamless process.

The overall goal is to help you make informed decisions designed to grow your business in the direction that you want.

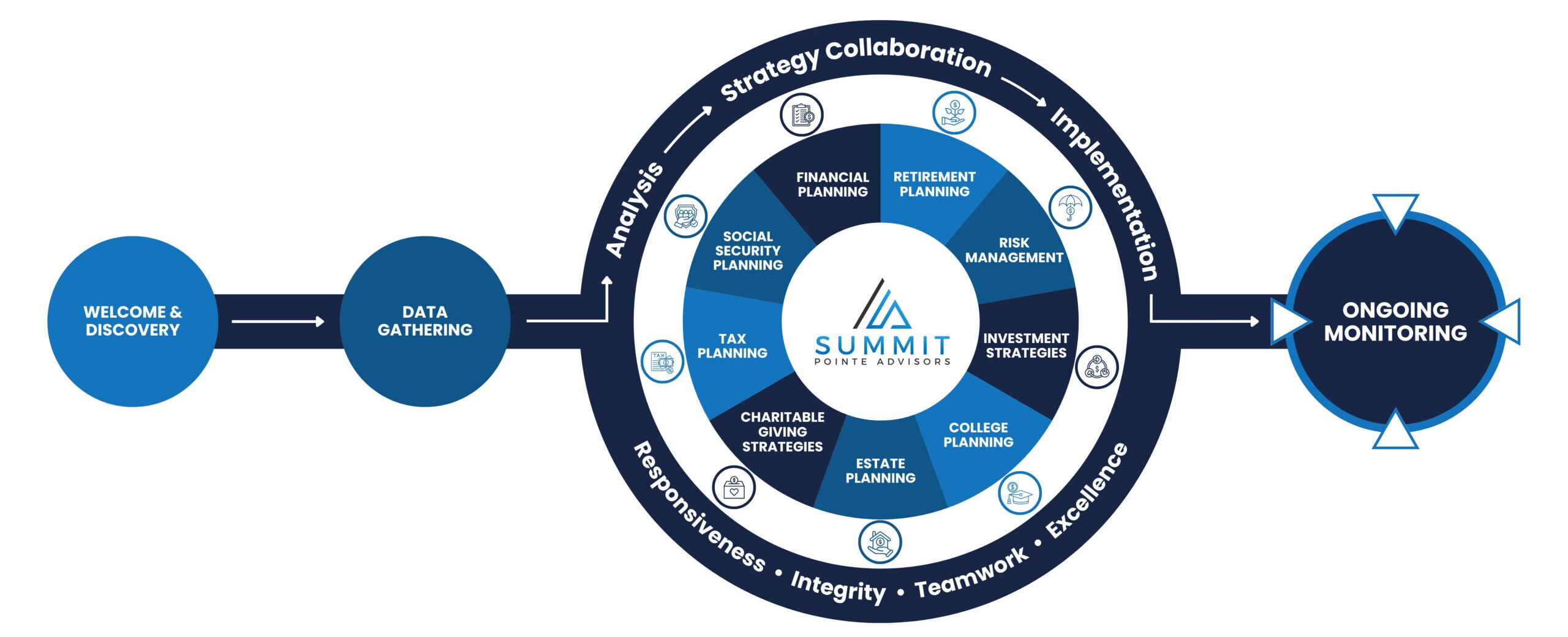

Financial planning will look a little different for everyone, but there are some common trends to planning outlined below. The chart below is more of a guideline, with each stage building off the last.

Business Planning

You know what it takes to build a successful business. It takes vision, preparedness, skills and desire – not to mention a focused dedication to achieving your goals. If you are like most business owners, you’ve worked hard and made many sacrifices to grow your business. That’s why you should put just as much energy into protecting it as you did building it.

Financial plan recommendations can be implemented with the advisor of your choosing. Implementation of specific products or services may result in commissions or fees outside of the financial planning fee.

Start Up

Focus: Strategic setup and risk management. Establishing financial stability and building a foundation.

Key Services:

Entity Structure Guidance

Choose the right legal structure (LLC, S-Corp, etc.) for liability protection and tax efficiency. Understand the business structure and tax obligations of your company.

Business & Personal Budgeting

Align personal financial goals with business cash flow needs.

Cash Flow Management

Maintain tight grip on expenses. Explore funding options such as small business loans or grants.

Tax Planning

Coordinate with CPA for estimated taxes, self-employment tax, and deductions.

Insurance Review

Recommend appropriate business insurance (disability, key person, liability). Develop strategies to address unexpected contingencies like a death or disability of owners or key employees.

Retirement Plan Setup

Introduce retirement plan to begin building personal retirement savings.

Emergency Fund Strategy

Review liquidity needs – how much to keep in cash vs. reserve lines of credit.

Key Employee Retention Strategies

Create bonus plan to retain and reward top talent.

Buy/Sell Agreement

Develop buy/sell agreements

Key Services:

Business Valuation Benchmarks*/Strategic Planning

Reassess goals, Introduce longer-term financial forecasting (3-5 years). Track growth and inform decisions around expansion or investor interest.

Team Growth

Plan for hiring, benefits, and retention strategies. Design retirement and health plans to attract and retain talent.

Risk Management

Develop strategies to address unexpected contingencies like a death or disability of owners or key employees.

Profit Margins

Focus on improving margins and reinvesting in high-ROI areas. Developing and understanding your strengths and profitability.

Debt Strategies

Use leverage smartly; ensure debt is structured efficiently. Help balance business debt with long-term capital needs and personal liabilities.

Investment

Consider investing in new tech, product lines, or markets. Guide how and when to diversify business profits into personal investment portfolios.

Tax Efficiency

Optimize for deductions, credits, and possibly restructure- for savings (e.g., S-Corp election). Identify tax-advantaged retirement plans (defined benefit, 401(k), profit-sharing, etc.)

Key Employee Retention Strategies

Create bonus plan to retain and reward top talent.

Buy/Sell Agreement

Review or update buy/sell agreements.

Growth & Expansion

Focus: Scaling operations, improving profitability, and managing risk.

Succession & Exit Planning

Focus: Maximizing value, succession, and wealth preservation.

Key Services:

Succession or Exit Planning

Develop exit strategies – family handoff, selling to partners, or third-party sale. Solidify buy/sell agreements.

Business Valuation Support

Increase business value through strong financials, customer base, and IP. Coordinate with valuation experts.

Tax & Estate Planning

Strategize how to reduce capital gains and estate taxes on sale or transfer.

Diversification

Shift personal wealth outside the business to reduce concentration risk.

Personal Retirement Income Plan

Shift focus to drawing down from investments and planning distributions.

Legacy Planning

Align financial decisions with long-term personal or philanthropic goals. Coordinate with an estate attorney on wills, trusts, and gifting strategies.

Risk Management

Develop strategies to address unexpected contingencies like a death or disability of owners or key employees.

Business Planning Services

Financial Planning

This is a highly collaborative process involving coordination with multiple outside professionals. The process of setting financial goals, creating strategies to achieve them, and managing resources effectively to help ensure long-term success. Financial planning encompasses each of the categories below as part of a wholistic approach.

Key Aspects of Financial Planning:

Goal Setting

Performance Monitoring

Cash Flow Management

Risk Management – prepare for the unexpected

Why It's Important:

Financial planning for your business provides a clear roadmap for resources, building growth, and maintaining financial stability. It helps business owners make informed decisions, anticipate challenges, and seize opportunities with confidence. A solid plan can help businesses put strategies in place that are designed to minimize vulnerability to cash flow issues, inefficiencies and unexpected risks.

Retirement Plans

Setting up retirement plans for both you and your employees is important. Your financial advisor will guide you through selecting and setting up the right plan for your business, balancing cost, tax benefits, and administrative needs.

Key Elements of Retirement Plans:

Plan Selection

401(k) / 403(b) / Profit Sharing

- Solo

- Safe Harbor

- Traditional (pre-tax) / Roth

SEP IRA / Simple IRA

Defined Benefit Plan

Cash Balance

Contribution Planning & Compliance Testing

Ongoing reviews with client and employees

Why It's Important:

Selecting the right retirement plan helps you, as a business owner, build personal wealth in a tax-efficient way while also attracting and retaining talented employees. A well-designed plan will focus on reducing your tax burden, supporting long-term financial security, and shows your commitment to your team’s future. Wise design helps ensure that the plan will fit your business’s size, cash flow, and growth goals.

Executive Benefit Programs & Key-Person Protection

Non-Qualified Executive Benefits

Deferred compensation plans

Split-dollar life insurance plans

Executive bonus plans

Group carve-out plans

Key Person Protection

These people are the most important asset of your business. It would take time and money to replace them. It’s important to understand the cost and time it would take to replace a key employee.

Often, key person protection is handled utilizing term and whole life insurance.

Why Executive Benefit Programs and Key Person Protection is important:

Providing programs like these can incentivize employees to work their hardest and stay with your company for many years to come.

Exit Planning

Types of Exit Planning:

Family handoff

Third-party sale

Selling to partners

Why It's Important:

The goal is to maximize the value of the business and ensure a smooth transition that meet’s the owner’s financial, personal, and legacy goals.

Buy-Sell Agreement

Two types:

Cross Purchase

Co-owners buy out the departing owner’s share

Entity Owned Life Insurance

The company makes premium payments, and if the person dies, the company receives the death benefit. This helps alleviate some of the financial burden of replacing a key person in your company.

Why It's Important:

A buy-sell agreement helps ensure a smooth transition for your company and protects continuity of business. Pre-planning can help reduce the legal and financial risks if the unexpected occurs.

Employee Education

Topics Include:

Becoming financially independent

Employee financial wellness

Planning for Retirement

Common money mistakes

Financial Wellness Overview

Understanding Social Security

Why It's Important:

Employee education empowers your employees and can lead to better decision making and improved retention.