High-Net-Worth Financial Planning

Navigating with a Client Service Mindset

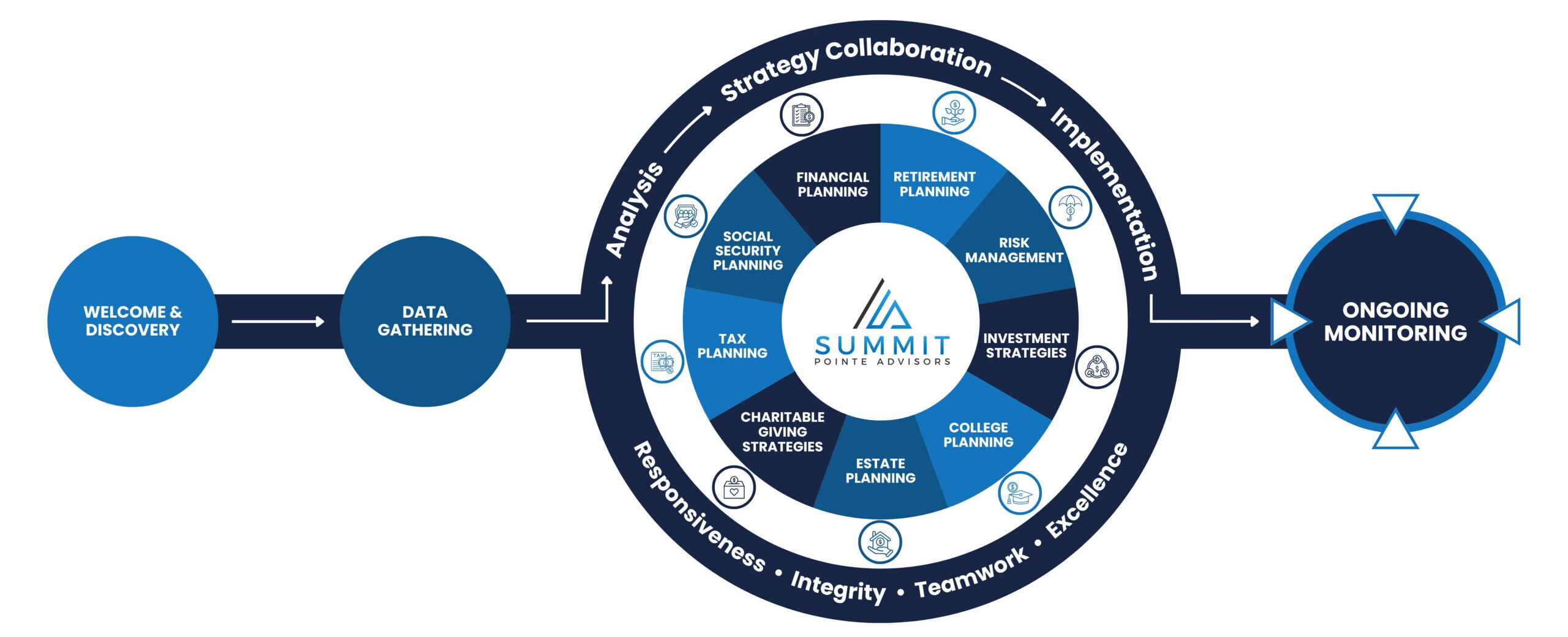

High-net-worth financial planning is not just about managing wealth. It’s about orchestrating a long-term vision that spans generations. It involves multi-generational legacy planning, business succession, philanthropy strategy, and the stewardship of complex estate structures. For individuals and families with significant assets, a high-touch wealth management model approach becomes essential as it offers centralized coordination across legal, tax, investment, and lifestyle domains.

Financial plan recommendations can be implemented with the advisor of your choosing. Implementation of specific products or services may result in commissions or fees outside of the financial planning fee.

High-Net-Worth Financial Planning Services

Wealth management

Wealth management for high-net-worth individuals is a strategic process focused on preserving, growing, and transferring wealth in alignment with your values, goals, and legacy. Alongside professionals such as CPAs and attorneys, an integrated wealth management structure provides enhanced oversight, reporting, and governance across all planning.

Key Aspects of Wealth Management Include:

Alternative investments (hedge funds, real assets, venture capital)

Private equity and co-investment opportunities

Separately managed accounts (SMAs)

1031 exchanges for real estate optimization

Direct indexing for tax efficiency

Why It's Important:

Multiple income streams, properties, trusts, and business interests require coordinated oversight. An integrated wealth management structure helps ensure that your financial planner, CPA, and legal advisors are aligned, empowering you to make decisions with clarity and confidence.

Tax Management

Taxes are often the single largest expense for wealthy individuals. Proactive planning may help improve after-tax outcomes and support the efficient transfer of wealth to heirs through estate and gift strategies.

Any discussion of taxes is for general information purposes only, does not purport to be complete or cover every situation, and should not be construed as legal, tax or accounting advice. Clients should confer with their qualified legal, tax and accounting advisors as appropriate.

Key Elements of Tax Management Include:

Tax-loss harvesting across portfolios

Municipal bonds for tax-free income

Accelerated depreciation investments

Roth conversions for long-term tax efficiency

Tax-efficient exchange-traded funds (ETFs)

End of year tax roundup

Why It's Important:

Financial Planning can help address risks such as outliving your money, paying more in taxes than necessary, or not being able to meet your goals for retirement. A strong retirement income plan can give you clarity and confidence.

Risk Management

Risk management is about safeguarding wealth from threats including financial, legal, and personal. High-net-worth individuals face unique exposures, from liability risks to cyber threats. Summit Pointe Advisors helps assess and mitigate these risks through tailored insurance strategies and legal protections.

Key Elements of Risk Management Include:

Advising excess liability protection

Irrevocable life insurance trust (ILITs)

Income and retirement contribution protection (Personal Disability Income Insurance)

Buy-sell agreement funding for business continuity

Review and considerations for cybersecurity protection

Survivorship life insurance

Split-dollar agreements

Premium financing for large policies

Deductible long-term care expenses for business owners

Why It's Important:

Standard insurance policies may not fully address the unique risks associated with high-value assets. Wealth attracts attention, making affluent families more vulnerable to lawsuits, fraud, and cyberattacks. Summit Pointe Advisors can support the development of a risk management strategy that reflects the complexity of your financial portfolio.

Estate Planning

Estate planning for high-net-worth families goes far beyond drafting a will. It’s about creating a comprehensive strategy to help manage, preserve, and transfer wealth across generations while minimizing legal hurdles and tax burdens. A collaborative team plays a critical role in coordinating legal documents, trust structures, and succession plans.

Estate Planning services are provided working in conjunction with your Estate Planning Attorney, Tax Attorney, and/or CPA. Consult them for specific advice on legal and tax matters.

Key Elements of Estate Planning Include:

Charitable giving strategies and donor-advised funds

Trusts

- Irrevocable and grantor trusts

- ILIT to leverage life insurance benefits

- QTIP consideration for divorcees

Complex beneficiary designations

Strategic lifetime gifting

Business succession planning

Family limited partnerships (FLPs)

Why It's Important:

For high-net-worth individuals, estate taxes may erode wealth significantly without proper planning. Complex ownership of assets and insurance require clear communication and coordinated efforts to help ensure transparency. A high-touch wealth management model assists in ensuring your wishes are honored, and your legacy is protected from probate delays and legal disputes.